Understand Every Part of Your Model

Learn how revenue, expenses, tax, assets, liabilities, equity and valuation outputs all connect - and how Model Reef handles these structures automatically so your statements always balance.

Master the Building Blocks of Your Financial Statements

These tutorials walk you through the core variable types that power Model Reef’s three-statement engine, helping you understand how everything fits together.

Revenue, Expenses and Tax

Model revenue patterns, cost structures and tax flows - and see how they connect to your P&L and cash movement automatically.

Assets, Liabilities, Equity and Opening Balances

Understand capex, loans, working capital and equity flows, and how opening balances are set so your balance sheet always balances.

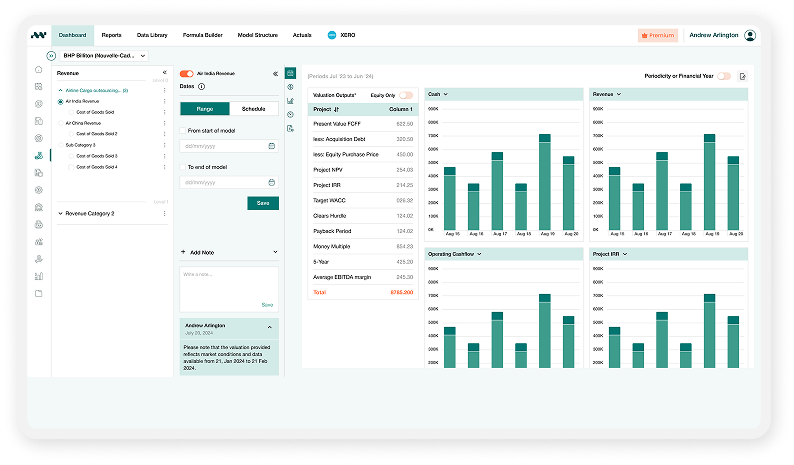

Valuation and DCF Outputs

View valuation outputs generated automatically from your cashflows, including present values displayed in the Cash Waterfall.

Once you understand these variable types, you’ll see exactly how each assumption flows through your full financial model.

Expand Your Skills

Go deeper into structure, modelling logic and analysis with these complementary tutorial tracks.

Model Structure

Design clean, scalable model structures and learn how branches, toggles and consolidation work together.

Drivers, Variables & Formulas

Define drivers, create variables, and write formulas that shape the behaviour of every line in your model.

Charts, Reports and Scenarios

Turn the outputs of your model into dashboards, charts, reports and scenario analysis that drive clarity and decision-making.

See all tutorials and continue your learning journey.

See How Teams Use Model Reef

From finance teams to investors and advisors - learn how these variable types power valuation, planning and reporting workflows across industries.

Ready to Build Your First Model?

Start your free 14-day trial and experience how Model Reef transforms complex financial structures into clear, balanced, decision-ready models.

Want to explore more? Compare plans.