Valuation and DCF Outputs

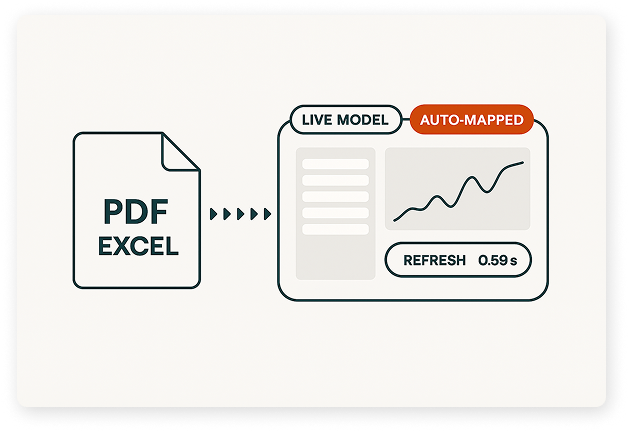

See valuation outputs generated automatically from your forecast. Model Reef calculates free cash flows, discounting and terminal value for you - and presents it all in a clean, decision-ready view.

Watch: Generate a Valuation in Seconds

Follow these steps to review your valuation outputs, adjust key assumptions, and understand how cashflows drive enterprise value.

Step 1: Review Cashflows

Step 2: Set Valuation Assumptions

Step 3: View DCF Outputs

See the Difference Instantly

Before Model Reef, building a DCF meant writing formulas, linking schedules and checking calculations. Now your valuation appears automatically - consistent, transparent and always tied to your latest model.

| Task | Before Model Reef | After Model Reef |

|---|---|---|

| Calculate Cashflows | Manual setup | Auto-generated FCF |

| Apply Assumptions | Complex logic | Clean, editable inputs |

| View Valuation | Build charts by hand | Ready-made DCF outputs |

Your valuation appears the moment your model is built.

Valuation Without the Manual Work

Model Reef turns your forecast into decision-ready valuation outputs - giving you instant clarity on enterprise value, cashflow timing and scenario impacts.

Clarity in decisions

See how cashflow patterns and assumptions drive valuation instantly.

Accuracy you can trust

Discount rates, terminal value and free cashflows follow clean logic.

Speed that saves hours

Skip valuation templates - your DCF is ready automatically.

Experience valuation modelling that’s fast, clean and reliable.

Keep Learning, Keep Exploring

Every tutorial builds on the last - helping you connect your forecast, cashflows and valuation into a single, coherent modelling workflow.

Each new concept strengthens your understanding of how assumptions and performance shape enterprise value.

Explore the Features Behind This Workflow

Model Reef automates valuation logic and integrates it with your model - giving you powerful tools for planning, reporting and investor conversations.

Real-Time Scenario Analysis

Instantly compare valuations under upside, base and downside cases.

Driver-Based Modelling

Use drivers to shape revenue, margins and cashflows that power the DCF.

Interactive Dashboards

Visualise value drivers, FCF timing and scenario impacts clearly.

Real-Time Collaboration

Share valuation insights and work with teammates in one model.

See all features that elevate your valuation process.

Ready to See Your Valuation?

Start your free 14-day trial and generate a complete valuation automatically - no templates, no formulas, no setup.

Want to explore more? Compare plans